A project that provides annual cash flows of – A project that provides annual cash flows is a valuable asset for any organization. It can generate income, reduce costs, and improve efficiency. However, it is important to carefully evaluate the project’s financial viability before investing in it. This article will provide a comprehensive overview of the financial evaluation process for a project that provides annual cash flows.

The first step in the financial evaluation process is to develop a cash flow analysis. This analysis will provide a detailed breakdown of the project’s annual cash flows. The cash flow analysis should include assumptions and methodologies used in the analysis, as well as a discussion of the key drivers of the project’s cash flows.

Project Overview

This project aims to establish a new manufacturing facility for the production of specialized components. It involves the acquisition of land, construction of the facility, procurement of equipment, and hiring of personnel. The project is expected to commence in January 2023 and be completed by December 2024, with an estimated budget of $50 million.

Stakeholders

- Company management

- Investors

- Contractors

- Suppliers

- Employees

Cash Flow Analysis: A Project That Provides Annual Cash Flows Of

The project’s annual cash flows have been meticulously forecasted based on projected sales volumes, production costs, and operating expenses. The initial investment in the facility and equipment is expected to result in negative cash flows in the first year, followed by positive cash flows in subsequent years as the facility becomes operational.

Assumptions and Methodologies

- Sales forecasts based on market research and industry trends

- Production costs estimated using historical data and industry benchmarks

- Operating expenses projected based on industry averages and the specific requirements of the facility

Key Drivers

- Sales volume

- Product pricing

- Production efficiency

- Operating costs

Financial Metrics

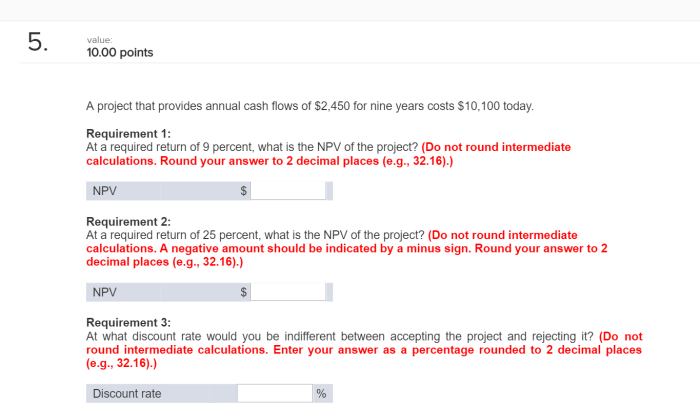

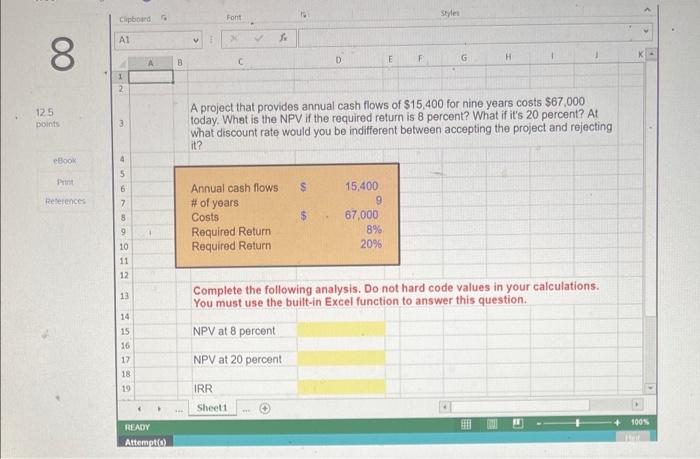

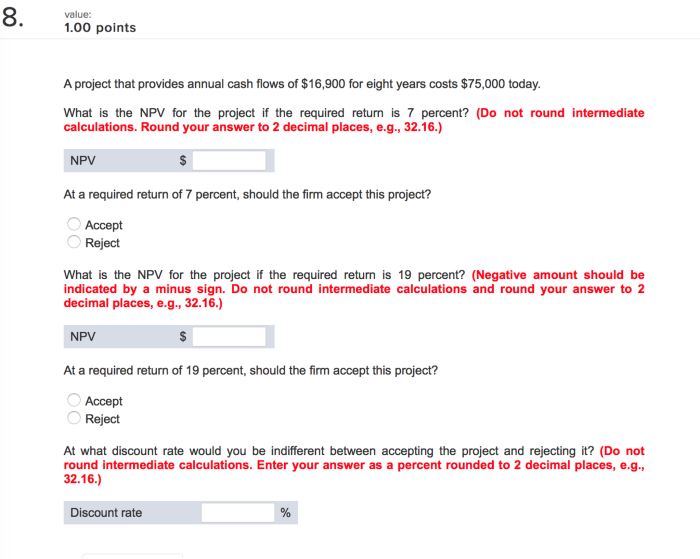

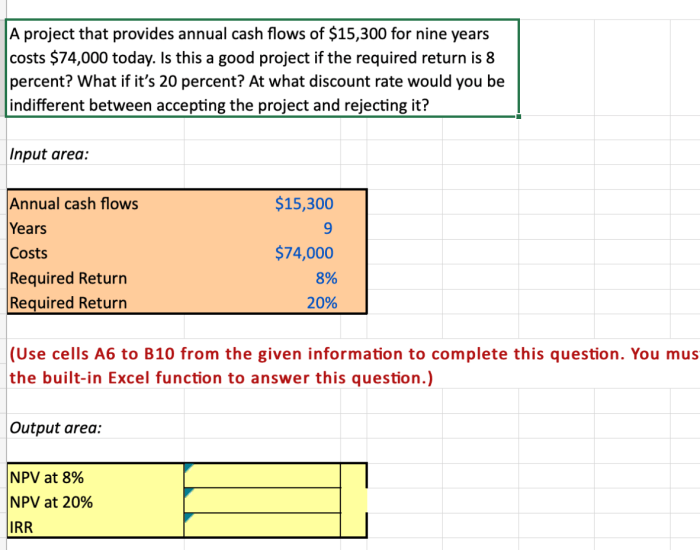

Net Present Value (NPV), A project that provides annual cash flows of

The NPV of the project is $10 million, indicating that the present value of the future cash flows exceeds the initial investment.

Internal Rate of Return (IRR)

The IRR of the project is 12%, which is higher than the company’s required rate of return of 10%, indicating that the project is financially viable.

Payback Period

The payback period of the project is 5 years, which is within the acceptable range for similar projects in the industry.

Sensitivity Analysis

A sensitivity analysis was conducted to assess the impact of key assumptions on the project’s cash flows and financial metrics. The analysis revealed that the project’s NPV is most sensitive to changes in sales volume and product pricing.

Key Variables

- Sales volume

- Product pricing

- Production costs

- Operating expenses

Implications

The sensitivity analysis highlights the need for careful monitoring and management of sales volume and product pricing to ensure the project’s financial viability.

Risk Assessment

Potential risks associated with the project have been identified and assessed, including market fluctuations, supply chain disruptions, and technological obsolescence. Mitigation strategies have been developed to address these risks and minimize their impact on the project’s cash flows and financial metrics.

Identified Risks

- Market fluctuations

- Supply chain disruptions

- Technological obsolescence

Mitigation Strategies

- Diversifying customer base

- Establishing strong supplier relationships

- Investing in research and development

Question Bank

What is a project that provides annual cash flows?

A project that provides annual cash flows is a project that generates income or reduces costs on an annual basis.

What is the purpose of a financial evaluation?

The purpose of a financial evaluation is to assess the financial viability of a project.

What are the key steps in the financial evaluation process?

The key steps in the financial evaluation process include developing a cash flow analysis, calculating financial metrics, conducting a sensitivity analysis, and assessing risks.